Find out how to get affordable car insurance in the USA in 2025. Learn what affects your rates, how to compare plans, and the top companies offering low-cost coverage this year.

🚗 Why Car Insurance Costs What It Does in the USA

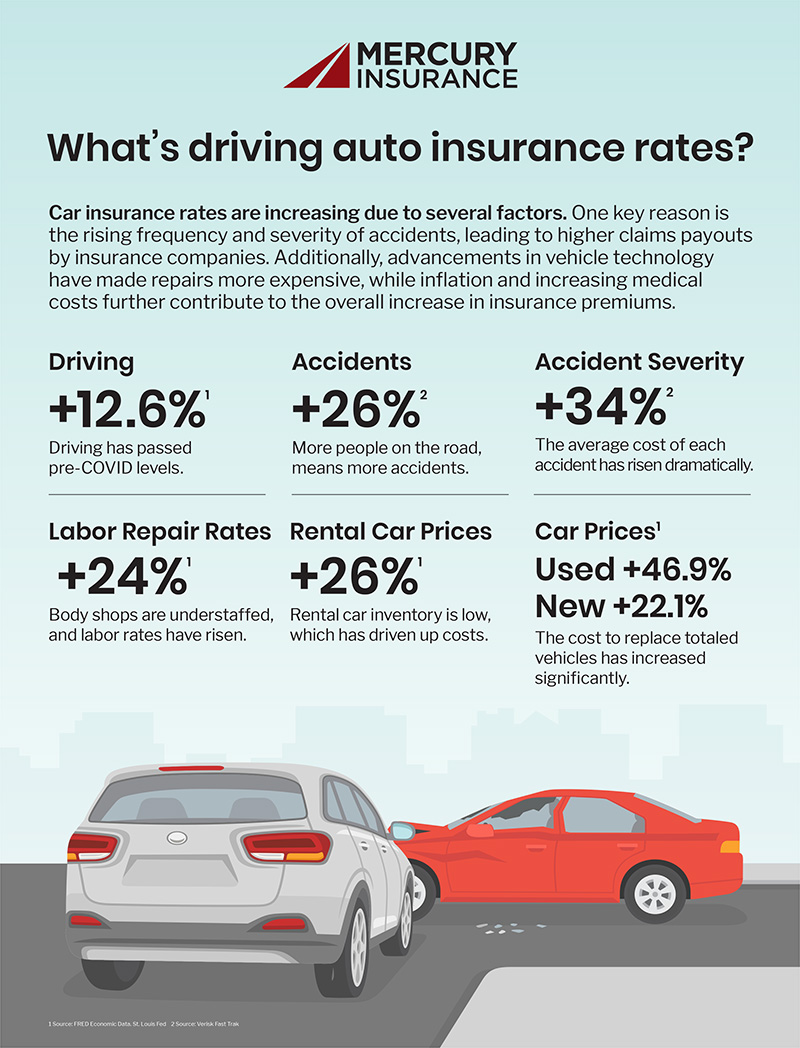

Car insurance premiums in the U.S. are rising every year — and 2025 is no exception. The average driver now pays between $1,700–$2,200 per year depending on location and coverage.

Your insurance rate is calculated based on several key factors:

- State laws and accident statistics

- Your driving record (tickets, claims, DUIs)

- Type of vehicle (sports cars cost more to insure)

- Age and gender (young male drivers often pay higher rates)

- Credit score (used in most states to calculate risk)

Knowing these helps you control costs and find the best deal.

💡 What Coverage Do You Actually Need?

Choosing the right coverage is the foundation of affordable insurance.

Here are the essential types:

- Liability Coverage – Required by law; covers injury or damage you cause.

- Collision Coverage – Covers repairs to your car after an accident.

- Comprehensive Coverage – Protects against theft, vandalism, weather damage.

- Uninsured Motorist Coverage – Important in states with many uninsured drivers.

Pro Tip: Combine liability + comprehensive + collision for balanced protection.

🧮 How to Compare Car Insurance Quotes Online

The best way to get cheap insurance is to compare at least 3–5 providers before buying.

Follow these steps:

- Visit quote comparison sites like The Zebra, Insurify, or Policygenius.

- Enter consistent data (same car, same driver info).

- Filter results by coverage level and deductible.

- Don’t just look at the price — check for customer reviews and claim ratings.

A few minutes of research can save you hundreds each year.

💰 7 Ways to Lower Your Car Insurance Premium in 2025

- Bundle policies (auto + home = 10–25% discount).

- Raise your deductible — higher risk, lower monthly cost.

- Install anti-theft devices in your car.

- Take a defensive driving course.

- Pay annually instead of monthly (many companies give discounts).

- Ask about low-mileage discounts if you drive under 8,000 miles/year.

- Maintain good credit — it can reduce your rate in most states.

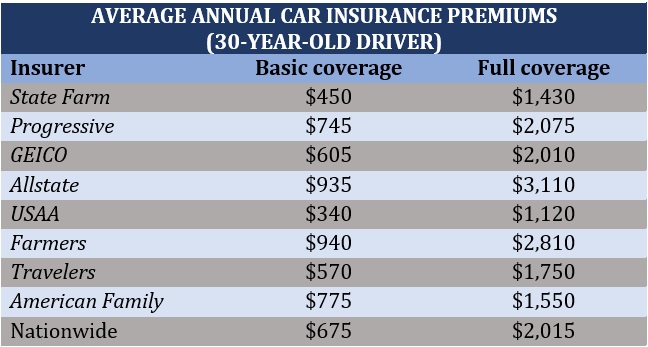

🏆 Best Car Insurance Companies in the USA (2025)

| Company | Average Annual Premium | Best For |

|---|---|---|

| State Farm | $1,310 | Overall reliability |

| GEICO | $1,250 | Tech-savvy & app discounts |

| Progressive | $1,420 | Custom policies |

| Allstate | $1,480 | Full coverage options |

| USAA | $1,180 | Military families (exclusive) |

💬 Always check for state-specific insurers — sometimes local providers offer cheaper coverage.

⚠️ Common Mistakes to Avoid

- Choosing only minimum coverage — it may not protect you fully.

- Forgetting to update your policy after moving states.

- Ignoring available discounts (good student, safe driver, etc.).

- Not reviewing your policy yearly.

These small errors often cost drivers hundreds in avoidable expenses.

❓ Frequently Asked Questions

Q1: What is the cheapest state for car insurance in 2025?

→ Maine, Vermont, and Idaho offer the lowest average premiums.

Q2: Can I switch my insurance company mid-policy?

→ Yes, you can switch anytime and even get a refund for unused months.

Q3: Does my credit score affect car insurance rates?

→ Yes — except in states like California and Hawaii, where it’s banned.

✅ Final Thoughts — Find the Right Plan for Your Budget

Affordable car insurance isn’t about finding the cheapest — it’s about finding the smartest coverage for your needs.

Always compare quotes, ask for discounts, and update your policy yearly.

Your car deserves protection — and so does your wallet. 🚘💵